Notes from China, Ashmore Outflows, and Exclusive Access to Our Defense Data

Editor’s Note – Clarification on Ashmore Flows

Following today’s post, I received a note from Ashmore Group’s communications adviser offering additional context on the reported $3.9bn in outflows.

They clarify that the redemptions were not driven by small-cap equities, but rather a small number of institutional redemptions from Local Currency strategies. Mark Coombs, Ashmore’s CEO, further noted that these outflows “do not appear indicative of a broader pattern of client activity,” and pointed to continued investor interest in EM strategies.

On the broader picture, he added:

“There are increasingly powerful reasons for investors to rebalance their asset allocations away from the US capital markets… these factors point to a weaker US dollar, which will be supportive for the performance of Emerging Markets.”

While our April 10 note anticipates institutional outflows from EM Small Cap vehicles — and we stand by that — I’m sharing this clarification in the interest of balanced reporting.

Dear Readers,

Three things for you today — each quite distinct, but all part of the same map.

1. Notes from the Ground: China, April 2025

I'm sharing my notes from my meetings with policymakers/investors/analysts from my ongoing trip to China. The observations are live, specific, and intentionally shared with all readers today.

Read here: Click to access the note

2. Ashmore Outflows: You Read It First

This morning, Ashmore reported $3.9 billion in quarterly outflows. Below is the screenshot of today’s headline, and below that — a paragraph from our April 10th client note, in which this was flagged clearly.

If you do not already have access and want priority access to future institutional notes, you can request access here:

Click to Access Request Form

3. Aerospace & Defense: Selective Access to Proprietary Data

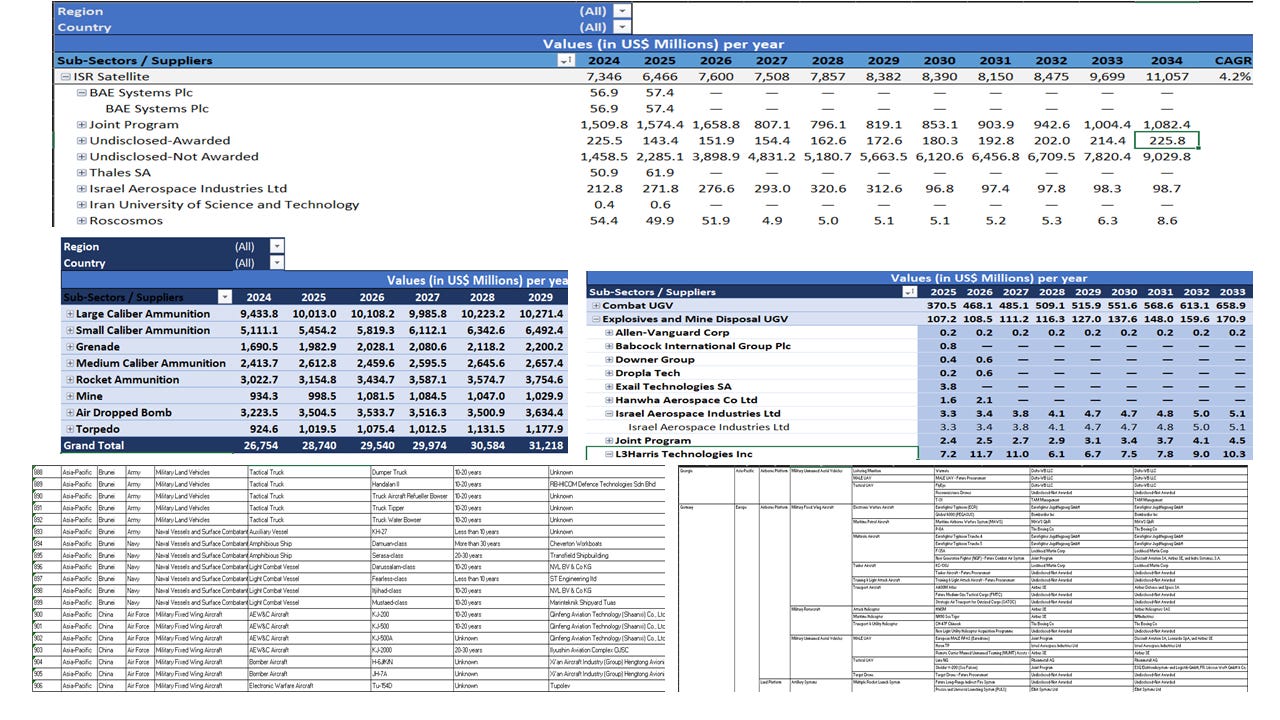

We’ve compiled a deep data pack on the aerospace and defense sector: capital flows, program-level tracking, geopolitical overlays, and procurement linkages. It’s not for everyone — access will be granted selectively. If approved, it will be shared at a nominal fee.

—

As always, thank you for reading.

As we continue exploring the complexities of global markets together, I’m genuinely humbled by the growth of this community—now 56,000+ strong. It’s an honor to engage with such an insightful and globally diverse audience, with readers spanning 101 countries, from the United States to Switzerland.

Your feedback and engagement have been instrumental in shaping the topics I explore. If you've found value in these perspectives, I’d love for you to share this newsletter with your networks. Together, we’re fostering deeper discussions and critical thinking about where the markets are heading. Please write to me at kam@amanahcapital.uk